Uplist in the News

The Mortgage Refinance Tool Every Loan Officer Needs in 2026

11.11.2025

Uplist Recapture™ a next-generation mortgage refinance database monitoring tool, gives loan officers a competitive edge.

Uplist Reports 184% User Growth in Q2 2025

08.15.2025

Loan Officers Embrace Uplist’s Recapture™ and SmartView™ Listing Flyers to Stay Ahead in Competitive Market.

With Rate Lock Activity Up, OB Introduces Automated Refi Tool

06.10.2025

The Optimal Blue and Uplist partnership is designed to ensure loan officers are ready when refinance volume picks up.

Uplist and Polly Partner to Power Loan Refinance Strategies

02.25.2025

This strategic integration empowers mortgage loan officers to proactively serve up-to-the-minute rate information.

Uplist’s Jeff Bell on Finding Efficiencies for Loan Officers

12.12.2024

EIC Sarah Wheeler sat down with Jeff Bell to learn about the importance in finding new efficiencies for loan officers.

Uplist Launches Recapture™ – Complete Refinance Solution

10.24.2024

Unlike other industry “rate alerts”, Uplist Recapture™ accurately automates the entire refinance analysis process.

From Browsers to Buyers: TikTok & LinkedIn for Mortgage Pros

03.19.2024

Uplist and SocialCoach join forces to share social strategies loan officers need to consider.

Seize the Future with the Right Attitude and Tools

02.01.2024

Uplist CMO, Ben Smidt, discusses the must-have technology tools for loan officers to succeed in Scotsman Guide article.

Jeff Bell Named 2023 Thought Leader Award Winner

12.07.2023

Uplist President, Jeff Bell, named 2023 Thought Leader Award Winner by PROGRESS in Lending for Innovation.

Social Media Secrets Coop+ Community with Uplist

11.20.2023

Uplist CMO, Ben Smidt, creates Knowledge Coop+ Community on Social Media Secrets to help loan officers.

Uplist Unveils Innovative Real Estate Technology for Lenders

10.25.2023

In a challenging mortgage market, lenders can now provide automated real-time payment quotes for active listings.

Recapture™ Adoption Surges as Lenders Gear Up for Refi Market

10.17.2025

Uplist Recapture™ now tracks more than $100 billion in active loans and surfaced over $6 billion in mortgage refis.

Boost Real Estate Sales with SmartView™ Listing Flyers

08.05.2025

SmartView™ Listing Flyer from Uplist help real estate agents meet demand.

Uplist and Optimal Blue Launch ‘Capture for Originators'

06.09.2025

Optimal Blue’s latest innovation takes the manual effort out of refinance lead generation, thanks to Uplist technology.

Uplist Continues to be Awarded Honors for Industry Innovation

02.12.2025

The innovative tool, Uplist Recapture™, continues to revolutionizes mortgage refinancing process.

Jeff Bell of Uplist Talks Leadership Coaching and Tech

10.28.2024

Jeff Bell discusses automated loan monitoring with Recapture™ to enhance refinancing efforts and recapture rates.

Uplist Launches Automated Refi Analysis Tool for Loan Officers

10.22.2024

‘Recapture™’ is integrated with the leading PPEs and provides fast, accurate data for multiple refinance scenarios.

Uplist Wins the 14th Annual Innovations Award

03.16.2024

Uplist named one of the top mortgage industry innovations in 2024 by PROGRESS in Lending.

Uplist Integrates with nCino Mortgage Suite (SimpleNexus)

01.23.2024

Uplist users can provide prospective homebuyers instant access to rates and payments through nCino mortgage app.

LoanPASS Integrates with Real Estate Proptech Company, Uplist

12.06.2023

The strategic integration will allow mortgage lenders to access certain Uplist products via the LoanPASS pricing engine.

Technology Needs to Make Your Life Easier or It's Not Worth It

11.03.2023

Technology should make our lives easier. If it doesn’t, why use it? Jeff Bell, Uplist founder, takes this mantra to heart.

Jeff Bell Wins 2025 HW Vanguard Award

09.03.2025

Jeff Bell transforms mortgage industry with tools like Recapture™ and SmartView™ Listing Flyers.

Uplist Recapture™ User Closes Two Refis in First 30 Days

07.25.2025

Uplist Recapture™ is helping mortgage professionals unlock refinance opportunities in a big way.

Uplist Partners with Polly, Offering Insights to Loan Officers

03.05.2025

Grants loan officers access to real-time insights that are designed to improve borrower assistance and engagement.

Uplist Wins Coveted HousingWire Tech100 Mortgage Award

02.03.2025

HousingWire’s Tech100 award honors Uplist as one of the most innovative and impactful tech organizations in housing.

Recapture™ Comprehensive Refinance Solution

10.28.2024

Uplist Recapture™ accurately automates the entire refinance analysis process with a click of a button.

Loansifter and Uplist Partner to Provide Brokers Real-Time Rates

06.03.2024

Brokers can now showcase their competitive rates to potential home buyers and to build stronger relationships with more agents.

There's Always Time if You Make Time with Technology

02.29.2024

Uplist’s CMO Ben Smidt discusses how loan officers can modernize the loan process with fresh technologies in 2024.

Easily Capture Business from Agents, Builders & Homebuyers

12.20.2023

In this episode Uplist CMO, Ben Smidt, talks about the value of AI, efficiencies and how Uplist accelerate the home loan process.

Real Estate Now Podcast: Technology Must-Haves for 2024

12.05.2023

On this episode of “Real Estate Now” Ben Smidt, CMO of Uplist, shares why Uplist is the tech you need to know about.

Innovative Real Estate Technology for the Savvy Loan Officers

10.27.2023

Tech startup, Uplist Technology Company, innovates real estate market with automated real-time mortgage rates inside listing flyers.

Capture for Originators Available in the Optimal Blue® PPE

09.02.2025

OB users can Instantly find refinance opportunities with Optimal Blue’s Capture for Originators.

Optimal Blue & Uplist Introduce Lead Gen Tool for Originators

07.05.2025

Solution that automatically identifies an opportunity, provides pricing options and generates a presentation to the borrower.

Uplist Announces Partnership with Polly PPE Technology

02.26.2025

This strategic integration allows loan officers on the Uplist platform to access Polly’s revolutionary PPE system.

Uplist Recapture™ Snags 2025 Prestigious Innovations Award

02.01.2025

PROGRESS in Lending has named Uplist Recapture™ as one of the top industry innovations of the past year.

Four Pressing Topics as you Prepare for MBA Annual

10.25.2024

HousingWire CEO Clayton Collins sat down with loan originator turned software executive: Jeff Bell, President at Uplist.

Loansifter Integrates with Uplist Offering Brokers Real-Time Rates

06.01.2024

Integration empowers brokers to better serve prospective homebuyers with access to real-time rates through Uplist.

Uplist Sponsors Momentum Builder Conference

02.20.2024

Uplist is excited to share it will be a sponsor for the coveted 2024 Momentum Builder Conference in Las Vegas, NV.

Loan Officers Using Uplist Tech 10x Their Time Savings

12.11.2023

In an industry first, the Uplist technology suite provides real-time 2-1 buydown rate and payment options with a single click.

Partnership Empowers Loan Officers with Homebuying Tools

11.28.2023

LoanPASS and Uplist create strategic partnership to equip mortgage loan officers with market-leading technology.

Building Stronger Relationships in a Tough Mortgage Market

10.26.2023

Uplist’s unique suite of features eliminates the need for loan officers to update listing flyers with accurate rates.

Discover the Ultimate Relationship Builder 🚀

What our Customers are Saying

Uplist Recapture™ is the most originator-friendly tool of its kind for identifying refinance opportunities!

Uplist is a no-brainer. Easy to use. Great tool for helping my real estate agents move their listings faster in any market.

SmartView™ Listing Flyers are great. Awesome tool for both lenders and Realtors®. The feedback I have gotten has been very positive!

Uplist’s Recapture™ is an absolute must-have for any mortgage professional. The time it saves and opportunities it creates for business are unmatched.

Uplist is the perfect tool for delivering actionable mortgage data in my real estate listings. I love it and so do my agents!

Uplist has supercharged my real estate business! It’s helps me support my clients and saves me time. It’s a total win-win!

Uplist enhances our loan officers’ ability to serve clients proactively and strategically, giving them a competitive edge in any mortgage market condition.

The Uplist system is great! This software is the future of homeownership. Highly recommend you check it out!

I have a Realtor® team who really loves Uplist! The platform has helped me maintain and grow my partnerships.

Uplist SmartView™ Listing Flyers are a huge time saver. Our builders and Realtor® partners can quickly provide accurate mortgage data to buyers at any time.

Extremely easy to set up and use. My listing agents LOVE them! The technology is so simple. Great product!

I love Uplist! I’m using it every day to build relationships with my agent partners. Only took a few minutes to setup the first time I used it.

Lenders Ready To Make an Impact?

Uplist is the perfect SaaS solution for lenders who want to make a positive impact in any mortgage market. Uplist’s suite of features provides mortgage loan officers the tools they need to go out and capture more business. Explore one of the leading real estate technologies dedicated to lenders.

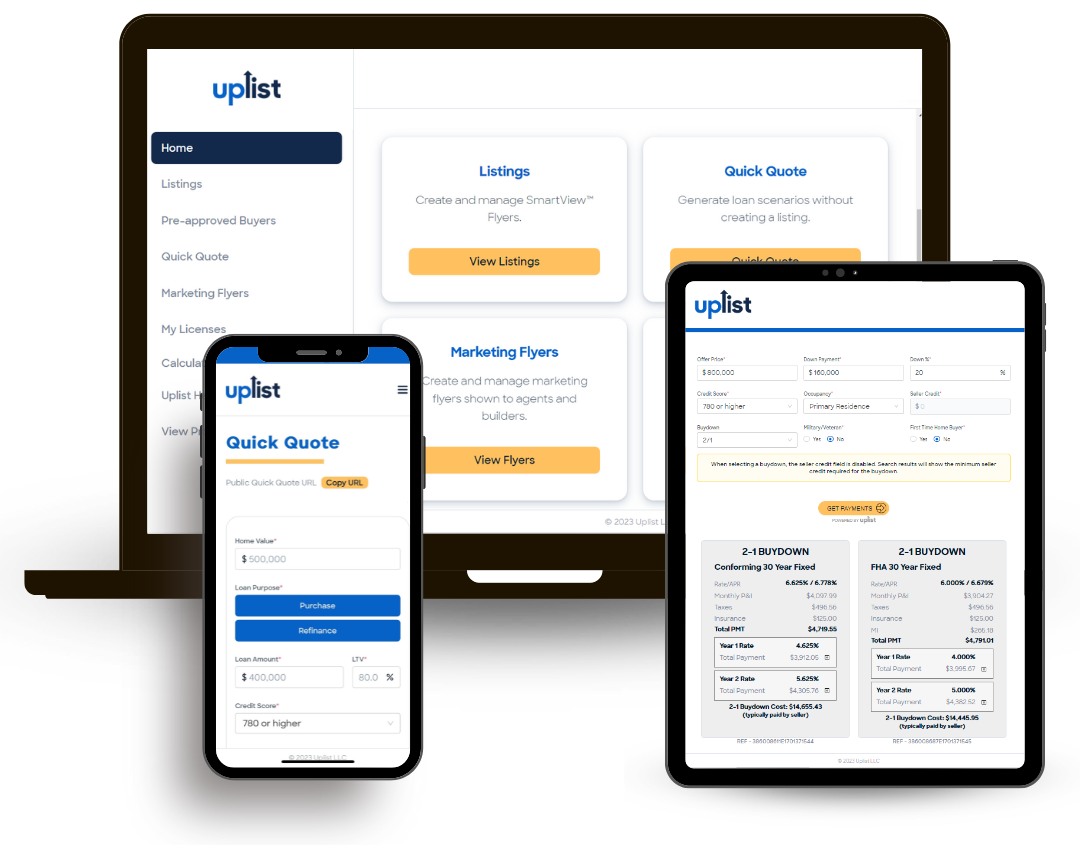

SmartView™ Flyers

Share Uplist SmartView™ Listing Flyers with your valued business partners that never require an update to rate and payment information.

2-1 Buydowns (and others)

Provide clients real-time 2-1 buydown rate and payment options, as well as the total buydown cost for any scenario with a click of a button.

Quick Quotes

This on-the-go feature allows loan officers to easily pull an accurate, real-time quote on potential properties for a homebuyer, without having to be in the office or at a desktop.

SmartBuyer™ Tool

Our mobile-friendly, white-labeled tool allows your homebuyers to search real-time rates and payments for ANY active listing, and then request a pre-approval with a tap of a button.